Author: Ina Mackinnon, founder of Alba Compliance Pte Ltd

Singapore’s AUM followed the global trend, rising by 15.7% in 2019 to reach S$4.0 trillion (US$2.9 trillion), with traditional sector seeing a strong rebound, registering 25% growth. source: Singapore Asset Management Survey 2019

Many have focused on cost containment during the pandemic of 2020, fund raising activities in general slowed to a halt as investors adopted a “wait-and-see” position whilst many fund managers were busy “fighting fire” at portfolio level.

The asset management industry is going through a colossal change. Current market stress has amplified what had already been a difficult environment of escalating costs and fee pressures.

What is in store for Fund Management Companies in 2021?

1. Operational Diversification

The FMCs are serious about achieving lasting diversity in the front, middle and back office. We see the trend of management action taken to redesign people and governance practices and challenge age-old traditional ways that COVID-19 has exposed. With the end of the pandemic now in sight, business operating models are being re-evaluated as FMCs examine core processes, cost structures and hybrid working environments as they drive for efficiency in a new normal.

Patrick Kirwan, Managing Director and Head of Client Operations for APAC at MUFG Investor Services has pointed out that “current operational challenges result in managers looking to outsource or co–source more, especially Middle and Back office functions including Compliance.”

Firms seeking greater efficiency have looked at Dedicated Compliance service providers, streamlining their operations through both outsourcing of non-core competencies and by implementing new technologies to improve reach and scalability.

2. Digital interaction and resiliency

Cloud-based solutions, artificial intelligence, Blockchain/DLT, machine learning & data analytics of the investor’s behaviors & patterns is a new value chain. We see the regulator to continue the trend to seek accountability for investor stability and investment advice, resulting more likely in lower fees, increased transparency and enhanced investor protection.

Leveraging today’s innovative technology and scalable solutions can significantly reduce costs and enhance operational efficiency. We expect the rise of FinTech to continue to revolutionize the fund industry, shake up the status quo of fund distribution.

A new generation of investors is also increasingly looking for digital solutions, with instant access to fund information. Fund distribution capabilities through smartphones, tablets and web-based solutions are a must when servicing these investors. Smaller asset managers must leverage resources, making use of a platform’ data to gain insights into investor behaviour, to help the asset management community find the right product and the right fit.

We expect that Ethical Data Analytics, Data protection & Data Security will continue to be on the regulators “radar”.

3. Rise of Smaller and Mid-Sized Managers

Given the increasing ease of outsourcing large parts of the activity chain, technology-enabled smaller players will be able to thrive despite the lack of traditional benefits of scale. Smaller managers create hyper-efficient operating models will achieve lower operating costs and greater operational flexibility and, by freeing up resources, the ability to focus on differentiating core investment capabilities.

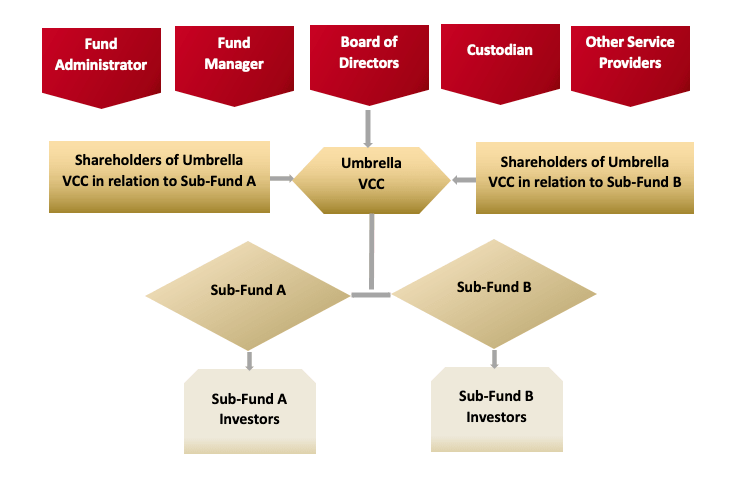

Singapore’ VCC framework (The VCC Act 2018, in force since 14th Jan 2020) was and still is considered as a “game changer”. Since its launch, the VCC has been well received by the funds community, as evidenced by the Accounting and Corporate Regulatory Authority (ACRA) registration an filing portal, as of 14th December 2020, there are 177 VCCs being incorporated, starting from 14th January 2020.

The MAS register lists total of 885 Registered and licensed fund managers, RFMC (288) and LFMCs (597, inclusive FIs holding multiple licences). To facilitate supervisory oversight of the VCC, we foresee an increase in FMC Licensing and Registration activity, though slowed in 2020 due to general slowdown in investors’ positions. Some reasons of the VCC framework attractiveness:

- The MAS VCC Grant Scheme allows for co-funding up to 70% of eligible expenses paid to Singapore-based service providers for a period of 3 years capped at S$150,000 per application with a maximum of 3 VCCs per fund manager, which will help cover costs involved in setting up a VCC.

- A VCC is not subject to capital maintenance requirements, allowing investors the flexibility to exit their investments in the fund when they wish to do so.

The MAS is fine-tuning this highly efficient and flexible framework, more likely we will see VCC 2.0 in 2022 – 2023.

4. Green and Sustainable Investing

A growing array of regulators are forcing the pace with environmental, social and corporate governance (ESG) disclosure requirements for financial players as the investors still face some challenges in determining what a sustainable fund does.

| ESG Focus Funds | Impact/Thematic Funds | Sustainable Sector Funds |

| Use ESG criteria as a key part of their security selection and portfolio construction process | Seek to make a measurable impact with investments on specific thematic areas like climate change, gender diversity, and community development. | Are non-diversified funds investing in mostly environmental-services industries and renewable energy. |

The Prospectus should provide clear, consistent descriptions on funds’ approaches to considering or incorporating ESG factors in their analysis and through their activities. The The companies must

- demonstrate “intentionality”

- Evaluate all aspects of ESG qualitatively and quantitatively.

5. Alternative and digital assets “going mainstream”

Bitcoin, Ethereum, and other cryptocurrencies/digital assets have captivated the attention not only of the public but fund managers looking to set up cryptocurrency-focused funds, finding their ways to find right corporate structuring, applying to be licensed with the Monetary Authority of Singapore.

“The stakeholders can now consider the VCC as a viable alternative to ICOs or feeder funds out of other jurisdictions. Thanks to Singapore’s well regarded judicial and arbitration system, it is an interesting jurisdiction attractive to cryptocurrency fund houses including Digital Native Assets in Australia that utilises the globally recognised TCM Capital managed TCM Digital Asset Fund in the Cayman Islands. James Walker, Managing Director of 153 East Partners the distributor of the Digital Native Assets Tracker Fund, shares the fund’s considerations to expand to Singapore: “The fund invests in the top crypto currencies and assets and is interested to further promote its institutional grade investment crypto platform to wholesale and sophisticated investors in the Asia-Pacific. APAC market’s fast paced growth provides undeniable advantages and opportunities that are hard to ignore. Regional inter-connectivity means adoption of a right fund passport scheme and regulatory framework to allow a compliant cross-border distribution could be significant. Digital Native Assets are open to considering partnerships with wholesale networks in Singapore.”

Core concepts to be mindful of:

- PSA: Singapore legislates and regulates crypto business by Payment Services Act

- DPT: Digital Payment Token. According to PSA, it encompasses “any digital representation of value that is expressed as a unit, not denominated in any currency or pegged to any currency, intended to be a medium of exchange accepted by the public as payment and can be transferred, stored or traded electronically.”

- PSN02: MAS notice on AML and CFT

All Singaporean crypto exchanges and businesses had to notify MAS and register before the 1st of March 2020.

How to apply for a MAS License for DPT services? We will be happy to answer your queries, whether specifically to outsourcing or any other regulatory compliance hurdles you may face.

For more information or advice about any of the trends in fund management outlined above, please contact Alba Compliance.